Institutional-grade FX trading platforms and APIs

We provide state-of-the-art and customizable technology that gives global market access and allows execution of complex trading strategies.

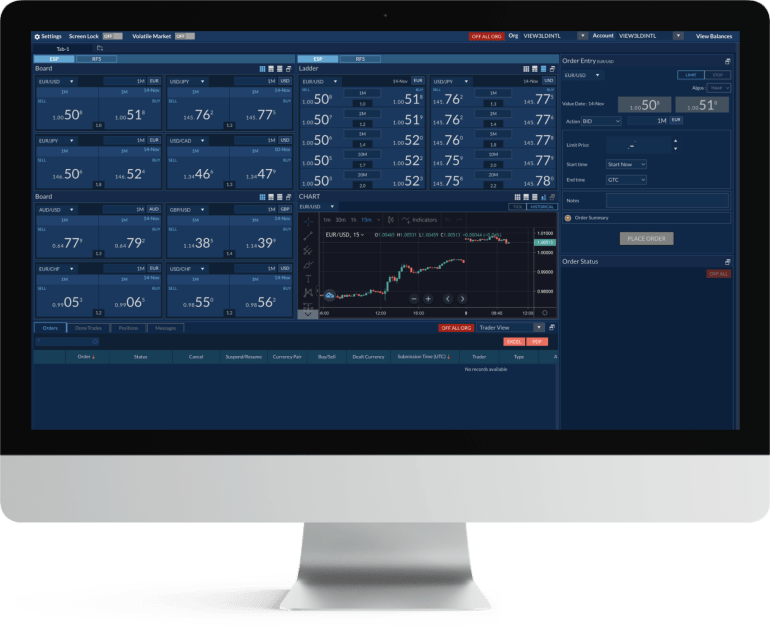

Professional FX trading platforms

Through a global network of proprietary and low latency third-party web and mobile platforms, our clients can trade a vast array of products globally.

- Access spot, forwards, swaps, NDFs, options and deliverable FX on a single account

- Benefit from 24-hour spot streaming prices, live real time post trade fix drop copy, and EOD reporting, 24/6 support access

- Trade same day value as well as TOM via RFS

- Trade thousands of FX and CFD products over desktops, web and mobile platforms

API connectivity

StoneX Pro provides API access to institutional FX liquidity and over 13,500 muti-asset CFD products. Our APIs enable our clients to connect their technology ecosystem to institutional-grade liquidity and execute their trading strategies over a low latency global network.

- Connect through multiple liquidity bridges and ECNs

- Benefit from advanced FIX 4.2 connectivity

- 24/6 access to support teams operating from 80+ offices across 6 continents

Access global FX trading ecosystem for institutions and corporates

StoneX Pro operates at the core of the institutional FX ecosystem. We have developed and fine-tuned our networks and our liquidity is available through multiple venues, platforms, and bridge technology, enhancing the speed of integration with our services.

- Access liquidity through multiple third-party platforms and ECNs

- Speed up time to market through existing bridge connectivity

- Leverage direct connection to StoneX Pro via our API

Cost-effective solutions using advanced FX trading technology

Our clients value the cost and time benefits of leveraging StoneX Pro’s expertise and cutting-edge infrastructure, allowing them to optimize operational efficiencies, accelerate time to market, and execute their trading most efficiently.

We provide a one-stop solution saving our clients the pain of having to aggregate liquidity, manage technology vendors, and handle individual PB relationships so they can focus on trading and benefit from reduced overhead and complexity.